What is the future of small business accounting in the AI age?

Nick Houldsworth

Contrary to the popular view that AI is about to eliminate entire professions, we believe putting expert powers in the hands of more people will only increase demand for advice from trusted experts. Here’s why.

Why do I care so much about accounting technology?

Let me get this out of the way first. I am not an accountant.

I have, however, worked in accounting technology for over a decade.

My father trained as an accountant, which meant, as a teenager, choosing whatever career was opposite to that. But by the time, some years later, I realised how improbable it would be to make a living playing guitar in a folk rock band, I had picked up enough skills in web development to set out and work for myself. Running a business is easy, I thought, until I had to file my first year end tax return, and lost the plot.

My brother, who was running a small retail business, introduced me to Xero, and for the first time, understanding the numbers became easy. It even became interesting. I learned to read a P&L. I had better conversations with my accountant. And that’s when I found my calling.. Helping technology give non-expert people like me - especially the time poor but passionate people who run their own business - expert powers.

That was 2009. The early days of the cloud technology explosion. I’ve been around long enough now to live through a few of those. My first Atari computer. Plugging in my first modem. The launch of the iPhone. Although they don’t feel like it at the time, on reflection, you appreciate the historical significance - a gradual but tectonic shift in the technology landscape.

Over the last decade, AI has always felt, at best, “just around the corner”, or, if you’re being unkind, a footnote on the gartner hype cycle (anyone recall the horror show of being subjected to scheduling a meeting through x.ai?). Then in November 2022, everything changed. And not the slow, transformational shift we saw before, but sudden, and jolting. Bringing with it a wave of almost euphoric possibility, but an equally strong undercurrent of fear.

For the record, I’m firmly in camp positive - if not euphoric, but definitely excited (on the inside, of course, I’m Kiwi, mate.) And while I have the ever present eye for risk that developed when I was a parent to three under three, after a year working at the coalface of solving real customer problems with AI, I feel much more pragmatic about an AI future. Let me share some background to help explain.

A new way to solve an old problem.

Our own AI journey at Prosaic started with trying to solve a data problem. Cloud software and the rise of the API economy saw an explosion in ease and availability of data. Modern accounting software like Xero works beautifully when connected to all the sources of data you need to reconcile and complete your tax returns - bank feeds from your business accounts, time sheets from your job management tools, OCR scans of receipts.

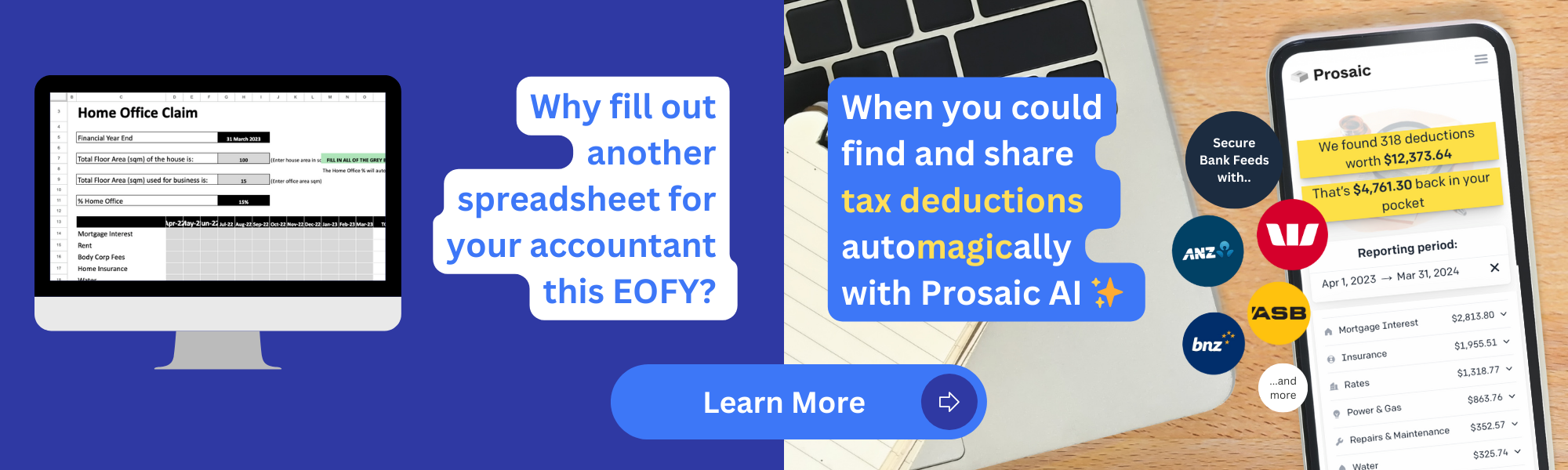

As a Xero user myself, however, there was always one, niggly part of the data puzzle that I couldn’t yet automate - finding, calculating and reconciling a long tail of personal expenses, that are separate from my business bank accounts, but still eligible to claim GST and income tax deductions because our business operates out of our home. When I shared this problem with my accountant, he said almost every client has the same issue.

With Open Banking coming to New Zealand, and providers like our friends at Akahu, my co-founder Rowan and I saw an opportunity to help small businesses unlock their financial data and streamline this part of their tax returns. But as we worked the problem, we hypothesised that the reason there didn’t appear to be any solutions in the market yet, wasn’t because of a lack of, but rather that there was simply too much data. Thousands of bank transactions a year from your average user, for only a few hundred claimable expenses. For most users, the it was clear that the investment of time to sort through all of this data was worth the return.

So we initially went about solving the problem like any good software developer would, by building a clever user experience - make it easy to filter through all your transactions to find the ones you want to claim. We even envisaged a kind of ‘Tinder for Business Expenses’ ("Swipe Left to Expense it!").

Fortunately, Chat GPT landed that same month, and we thought… What if the user didn’t have to do any work at all? So like millions of other users, playing with the tool for the first time to find out what it could do, I copy pasted a month of raw bank transactions into chat GPT and asked it to tell me what I could claim for my home office deductions. Here was the result. Cue exploding brain emoji.

AI offers a radically different way to interface with data

Prosaic was born out of this core insight. Open banking allows users to securely connect a wide range of financial data - thousands of transactions from multiple banks, cards and loan accounts - while generative AI offers unparalleled ability to enhance, organise, and analyse this data. And it does so with much less effort and input required of the user.

While much of the AI hype of the last year has focused on consumer products, text and image generation, there’s a wave of innovation coming for the more traditional (read, boring) workflow and business needs. More importantly, the way in which we've been conditioned to use with software, basically since the invention of windows and a mouse, is being turned on its head. Most of the workflow innovation of the last two decades of cloud software have basically been nicer looking web 1.0 forms. The user interface for AI native products will be much lighter, in many cases, it may not exist at all.

It's still early for Prosaic, and we’re just one part of the compliance workflow, but we also believe we’re one of the first novel, useful applications of generative AI in the accounting technology landscape. Fortunately, we have a small but growing base of forward thinking accounting partners, and business users who not only see the immediate value in our proposition, but see the early potential for AI to truly automate so much more of the drudgery and administrative work that still burdens small business owners and accountants today.

In other words, to finally take all those mountains of data that have been unleashed over the last decade of technology and connectivity, and transform it into something simple, and usable.

But…. (There’s always a but. And this is a big one.)

Having expert powers, does not an expert make.

Just because Chat GPT can write me a reasonable sale and purchase agreement for my house, doesn’t mean I want to sign a contract with a complete stranger, without first consulting a lawyer.

Just because I could ask AI to publish a Slack clone onto Replit, doesn’t mean I have a clue how to find customers, or even if I could, how to fix it when it breaks, or deal with an upset customer from the UK at 2am NZ time.

And just because GPT can turn my bank data into a pretty damn good expense report - when the risk of getting something wrong is literal jail - I definitely, DEFINITELY, don’t want to use it to file my taxes without my accountant reviewing it first.

Because while AI can at times feel magical, only humans have emotions, and there’s a feeling no machine can match - trust.

Accountants are still the most trusted profession when it comes to tax, and among the most trusted of all professions.

In an era of uncertainty, rapid change, and ever increasing challenges determining what is real from what is fake, trust becomes arguably the most valuable currency of all. For those in any profession who embrace the change, there will be plenty of opportunities.

Sure, it can be hard to keep on top of the change. Every week there is a new development in AI. A new tool - to make powerpoint presentations, then present them in mandarin, or simply order a burger from your favourite restaurant. There’s still a lot that can be automated in small business, and you don’t need to wait for the perfect tool. The best advice for anyone in small business or accounting is to simply try to solve one problem using tools like Google Bard, Microsoft Co-Pilot or Chat GPT. Heck, if you’re not even sure which problem to solve, just ask.

But with every new development in AI, comes the inevitable doomsayers. “THIS will be the death of lawyers / accountants / software engineers / architects / radiologists etc”. Fear drives clicks, and usually these claims are made by consultants incentivised by follower engagement, not by the practical realities nor experience of working in the humdrum and minutiae of business. There simply are, and will always be, many things for which you can’t rely on a machine. Which is why we believe..

AI will enhance human relationships, not replace them.

We designed Prosaic to augment the relationship between a small business and their accountant, not replace it, by doing the toil that neither of them wants to do.

Open banking enables small business users to share their data, then generative AI organises and enhances it, but the last critical mile is reviewed and verified by an actual expert. Less time spent by the accountant chasing and organising client data, means more time and better quality interactions with clients.

I’m not an accountant. You already know that. But I’ve been with the same accountant since 2009, I’ve met and worked with hundreds of other accountants in my time building software for small business, and I know that the promise of ‘Advisory’ (whatever that means for you) has also always just around the corner from the reality of the admin still required to complete compliance. For the first time in my technology lifetime, AI may finally remove the burden of administrative work, driving radical efficiencies in cost to serve and scale.

Sure, this will impact some types of work, and some jobs will evolve or disappear. But we strongly believe that by putting expert super-powers in the hands of a much wider base of users, AI will not reduce demand for actual, trusted experts, it will exponentially increase it.

Medium to large businesses still enjoy economies of scale advantages to stay ahead of smaller competitors, by being able to employ a CFO, teams of financial controllers and analysts. We see a near future where businesses of one, or two or ten, have access to the same or better expertise.

We believe this is the opportunity and the future for small business accounting in the age of AI.

------

Footnote

In case you were wondering, no, AI didn’t write this article for me. But it helped.

- I had the idea on my walk to work, and asked Siri to remind me to work on it when I got into the office.

- Later that morning I sat in a meeting room and spent 10 minutes dictating my unstructured thinking into Otter.ai

- I uploaded the transcript into Chat GPT and asked it to summarise the key themes.

- Then I used that, side by side, as I wrote, then rewrote, the actual words.

Out of curiosity, I then asked GPT to have a go at writing the article. If you like reading draft scripts from your local community screenwriting night school, then you'll love this. For everyone else, I think you'll agree it proves my point.