GST Returns: A guide for NZ Businesses and Sole Traders

Prosaic Team

Introduction

Understanding and complying with GST (Goods and Services Tax) requirements is crucial for small business owners in New Zealand. This step-by-step guide will walk you through the process of completing GST returns, offering insights on filing frequency, online submissions, utilizing accounting software, and claiming home office expenses.

How to guide for New Zealand small businesses completing GST returns

GST (Goods and Services Tax) is a consumption tax that is charged on most goods and services supplied in New Zealand. If you are a registered GST business, you are required to file GST returns regularly and pay any GST that you owe to Inland Revenue. Register for GST with the Inland Revenue Department (IRD) if your annual turnover exceeds NZ$60,000.

How often do I need to file GST returns?

You can choose to file your GST returns monthly, two-monthly, or six-monthly. Your taxable period must align to your balance date. If you did not choose a taxable period when you registered, Inland Revenue will put you on the two-monthly option matching your balance date.

Filing online vs using a GST101A form

If you have an IRD number, you can file your GST returns online through myIR. This is the fastest and easiest way to file.

To file your GST return online, go to the Inland Revenue website: https://www.ird.govt.nz/ and log in to myIR. Then, click on the GST tab and click on File a GST return. Select the taxable period for the return you are filing and enter the information requested on the return form. Once you have reviewed the return, click Submit.

If you do not have an IRD number, or if you prefer, you can file your GST returns using a GST101A form:

Using accounting software

- Leverage accounting software like Xero or MYOB for efficient transaction tracking and GST calculations.

- Ensure your software is updated and complies with New Zealand tax laws.

Claiming Expenses for Home Office Use:

If you use part of your home for business purposes, you can claim a proportion of your home expenses as GST input tax.

To calculate your home office expenses, you need to work out the percentage of your home that is used for business. You can do this by measuring the area of your home that is used for business and dividing it by the total area of your home.

Once you have worked out the percentage of your home that is used for business, you can claim a proportion of your home expenses as GST input tax. This includes expenses such as rent, mortgage interest, insurance, rates, and utilities.

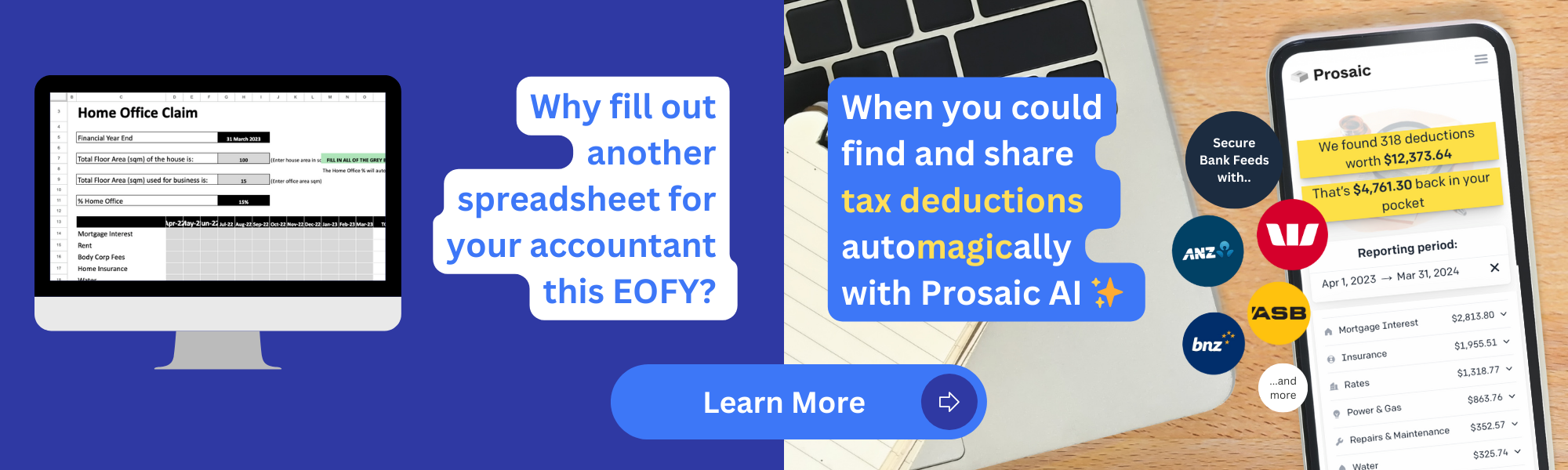

Claim GST and income tax deductions automatically using AI with Prosaic.

Completing and Submitting GST Returns:

When it comes to completing your GST return, accuracy is key. You have the option to file your return online via the myIR platform, or by filling out a GST101A form obtained from the IRD. Whichever method you choose, ensure that all the details are precise and reflective of your business transactions over the filing period. It's crucial to submit your GST return to the IRD before the due date to avoid any late filing penalties.

Payment:

Once your GST return has been filed, the next step is to settle any GST owed to the IRD by the specified due date. You can make your payment online or through other payment methods provided by the IRD. Conversely, if your business is due a refund, the IRD will typically process this refund and deposit the amount into your nominated bank account. It's advisable to check the IRD's payment guidelines to ensure that you comply with their payment procedures.

Review and Adjust:

After your GST return has been submitted and any necessary payments have been made, it's a good practice to review the entire process. Evaluate the efficiency and accuracy of your GST recording and filing system, and identify any areas that could be improved for future GST returns. This could be a good time to consider whether the use of accounting software or consulting with a tax professional could help streamline the process for subsequent returns.

Seek Professional Advice:

Navigating the realm of GST can be complex, especially for new or small business owners. It’s advisable to seek professional advice from a certified tax advisor or accountant who is familiar with New Zealand’s tax laws. They can provide personalized advice, ensure that your business is compliant with GST requirements, and potentially help you identify tax-saving opportunities. Remember, each business is unique, and a professional can provide tailored guidance to ensure your GST filing process is both compliant and efficient.