How to claim home office expenses - a guide for small business and sole traders

Nick Houldsworth

A guide for New Zealand sole traders and small business owners to claim income tax and GST deductions against the cost of running a home office

Working from home has become increasingly popular in New Zealand, and with it comes the potential to claim home office expenses against income tax and Goods and Services Tax (GST). This guide will provide you with a concise overview of the processes and requirements to claim these expenses, ensuring you maximise your tax deductions and GST credits.

Determine if you're eligible

To claim home office expenses against income tax and GST in New Zealand, you must meet the following criteria:

- You're self-employed or you own a business, and

- You use part of your home for business purposes (eg home office, storage etc)

If you don't meet these criteria, you may not be eligible to claim home office expenses.

Find out more about the IRD rules for claiming home office expenses on their website. In Australia employees are also eligible under certain circumstances to claim tax deductions against costs of working from home.

Identify deductible expenses:

You can claim various expenses related to your home office, including:

- Mortgage interest or rent

- Utilities (e.g., electricity, gas, water)

- Repairs and maintenance

- Insurance premiums

- Depreciation on office furniture and equipment

- Phone and internet expenses

Note that you can only claim the proportion of these expenses that relate to your home office. To determine this proportion, use the actual area of your workspace compared to your home's total area, or calculate the percentage of time you use the area for work purposes.

Claiming Income Tax Deductions

Keep accurate records of your home office expenses, including receipts and invoices. At the end of the financial year, you'll need to complete an IR3 Individual income tax return form (for self-employed individuals) or an IR4 Company income tax return form (for businesses). In the "Expenses" section, include the relevant deductible expenses. Ensure you maintain these records for at least seven years, as the Inland Revenue Department (IRD) may request them for audit purposes.

"It is always advisable to engage a professional accountant or book keeper to help you with this. Often their fees are easily covered by the net tax credits you may realise."

Claiming GST Credits

If you're registered for GST, you can claim GST credits on the portion of your home office expenses that relate to your business. To do this, include the relevant expenses in your GST return (either the GST101A or GST103 form, depending on your filing frequency). Remember to keep your receipts and invoices for at least seven years.

Periodic adjustments

If your home office expenses change significantly during the year (e.g., due to renovations or purchasing new equipment), you may need to adjust your income tax and GST claims accordingly. This can be done by updating your records and including the revised expenses in your tax and GST returns.

Summary

Claiming home office expenses against income tax and GST in New Zealand can provide significant financial benefits for those who work from home. By following the steps outlined in this guide and maintaining accurate records, you'll be well on your way to maximizing your deductions and credits. Always consult a tax professional if you're unsure about any aspect of the process or if you require further assistance.

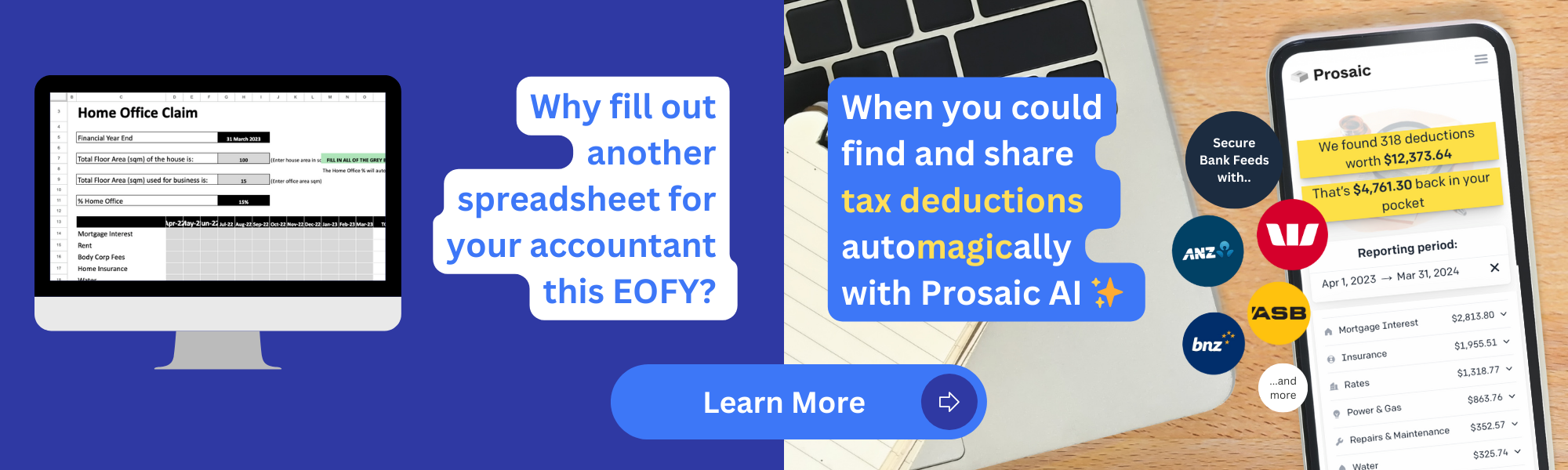

Prosaic app uses AI to help you automatically find and claim for home office expenses from your personal bank and credit cards. Find out more.