How To Find Tax Deductions In Bank Statements

Prosaic Team

Introduction

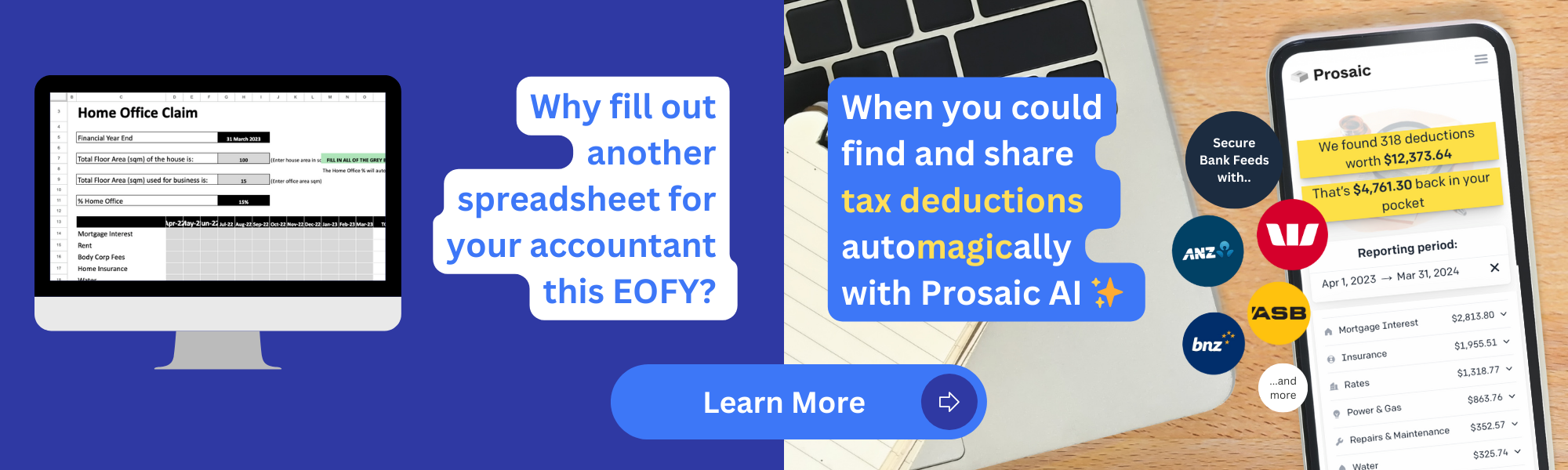

For small businesses and sole traders , bank statements offer a simple way to find potential tax deductions. The challenge of finding these deductions can be like looking for needles in a haystack, especially when poring over a year’s worth of transactions. This article covers how to quickly find these hidden savings and introduces a new tool: Prosaic, an AI-driven app designed to automate and revolutionise this task.

Finding Tax Deductions Manually in Bank Data

Unearthing tax deductions in bank data typically involves a series of time-consuming steps:

- Log into Online Banking: Access your accounts to review transactions for the entire tax year.

- Download Transactions to Spreadsheets: Export your transaction history, often requiring conversion into a spreadsheet format for easier analysis.

- Categorise Expenses: Manually sift through each transaction, categorising them into deductible and non-deductible expenses.

- Identify Potential Deductions: Employ your understanding of tax laws to pinpoint transactions that qualify as deductions, a process that’s prone to oversight and errors.

- Consult A Tax Professional: To ensuring that deductions are valid and current.

This method is not just arduous but also fraught with the risk of missing significant deductions, ultimately impacting your financial outcome.

Automating Deduction Discovery with Prosaic

Prosaic revolutionises the tedious process of deduction discovery into a straightforward, automated task. Here’s how Prosaic streamlines finding bank data tax deductions:

- Direct Bank Integration: Prosaic connects directly to your online banking, using open banking, accessing your transaction history without manual downloads.

- AI-Driven Analysis: Utilising advanced artificial intelligence, Prosaic analyses your transactions in real-time, identifying deductible expenses with precision.

- Automatic Categorisation: The app automatically categorises expenses, employing smart algorithms to distinguish between deductible and non-deductible transactions based on current tax laws.

- Seamless Sharing with your Accountant: Prosaic generates detailed reports of identified deductions, ready for tax filing, ensuring you claim every possible saving.

The Prosaic Advantage

With Prosaic, the era of manually combing through bank statements is a thing of the past. Small businesses and individuals can now uncover hidden tax deductions effortlessly, ensuring comprehensive tax savings. Prosaic not only saves valuable time but also maximises tax refunds by identifying deductions that might otherwise remain hidden.

Conclusion

Bank data holds the key to numerous tax deductions, but unlocking these savings manually can be daunting. Prosaic offers a seamless, automated solution to this challenge, revolutionising how small businesses and individuals approach tax preparation. By combining Prosaic’s technology with the expertise of a professional accountant, you can ensure maximum efficiency and savings in your tax filings.

Call to Action

Don’t let hidden tax deductions slip through your fingers. Try Prosaic today and transform your approach to tax savings. Visit [website] to learn more and start maximising your deductions effortlessly, and remember, consulting an accountant can provide you with tailored advice to complement Prosaic’s capabilities.