How to use Xero to claim tax deductions on home office expenses

Nick Houldsworth

Receive GST credits and a tax exempt cash contribution to your house-hold costs with our guide for small business Xero users on how to submit and claim tax deductions on expenses incurred using your home for business purposes.

Follow our handy guide to claiming home office tax deductions in Xero

Introduction

As small businesses face unprecedented challenges with rising costs, managing cash flow becomes paramount. This guide is tailored to small businesses, GST registered, using Xero, offering an opportunity to boost cash flow through regular GST credits, income tax deductions, and potential tax-free cash flow of hundreds of dollars a month.

If you're a GST registered business, and you use some of your home for business, you may be eligible to claim tax deductions against a portion of those costs. For more details, including how to work out your eligible portion read our guide on how to claim home office deductions

Three Key Steps for Success

1. Get Expenses in Accurately and Apportioned

Tracking and managing home office expenses is vital for claiming deductions and credits. There are three main methods to ensure accurate tracking:

Manually Tracking Expenses

While time-consuming, manually tracking expenses through bank statements and spreadsheets is a tried-and-true method. This approach involves exporting transactions, filtering eligible expenses, and calculating the claimable amount, separating GST claimable items.

Using Personal Finance Apps

Personal finance apps like PocketSmith can aid in tracking expenses, especially if diligent categorisation is maintained. These tools can expedite the process, but manual calculation and export to a spreadsheet are still required.

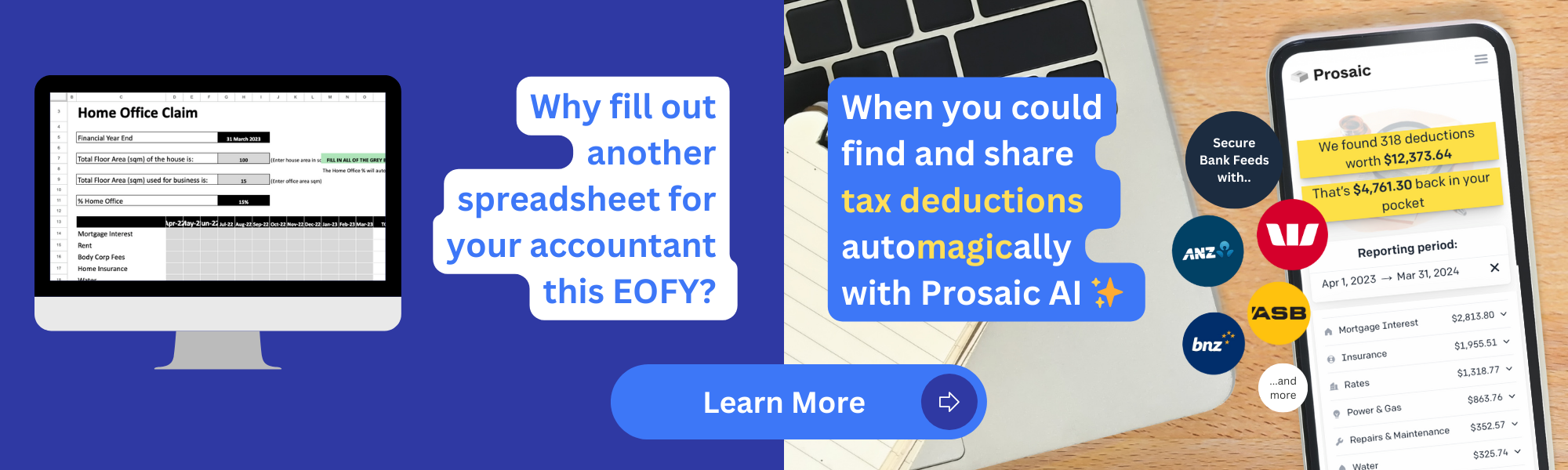

Streamlining with Prosaic

Prosaic offers an efficient way to handle expenses, connecting to bank accounts, and running transactions through a predictive expense engine. Within minutes, Prosaic identifies eligible expenses, allowing for quick tagging, percentage coding, and easy export to Xero.

2. Reimburse Yourself for Home Office Expenses

Reimbursing yourself for home office expenses is a two-fold process that involves creating a draft bill in Xero and making a direct payment from the business bank account to the personal account.

Creating a Draft Bill in Xero

The process begins by creating a draft bill in Xero, setting the end date for the GST period, and entering the amount for each home office expense category. You can set the quantity to your home office expense ratio (eg 20% = 0.2). Enter gross transactions amounts and set the invoice to GST inclusive and Xero will calculate any GST credits. Expenses eligible for GST must be separated from those not eligible (eg Rent, Mortgage).

For Prosaic users, a CSV file in a draft bill format can be imported directly, saving time and effort.

When entering a bill in Xero, you can either enter each expense or expense category (eg "telephone & internet") into a new line, and categorise it to your chart of accounts, or you can simply enter a summary of all home office deductions to a single chart of accounts (eg "home office expenses").

It is also recommended to upload any original transactions or calculations as an attachment to the bill, so there is an audit trail.

Paying Yourself

The approved amount can be paid directly from the business bank account into the personal account, effectively reducing total revenue and, consequently, the tax bill. This reimbursement can contribute significantly to household running costs.

3. Submit and Claim GST Regularly

Timely submission of GST returns not only helps to smooth cash flow but ensures that all eligible expenses are accounted for, including household items. Regular GST submission can add up to significant credit, especially when done every two months.

Read this article on how to submit GST returns through Xero

Benefits and Conclusion

Claiming home office expenses in GST returns and income tax deductions is not just a financial strategy; it's an essential approach to improving cash flow, especially in today's economic landscape. By following the steps outlined in this guide, small businesses can not only mitigate the impact of rising costs but also seize opportunities for regular GST credits and income tax deductions.

The methods described offer different levels of convenience and efficiency, with manual tracking providing control, personal finance apps offering some automation, and Prozaic delivering a streamlined solution. The decision on which method to adopt lies in balancing time, accuracy, and the potential financial gains.

Regularly submitting and claiming GST ensures that credits are received throughout the year, further enhancing cash flow. Additionally, proper reimbursement practices contribute tax-free cash flow to household running costs, providing relief in a time of economic uncertainty.

The ultimate benefit of this approach extends beyond mere numbers. It empowers small businesses and sole traders to take control of their financial destiny, leveraging tools and practices to ensure stability, growth, and resilience in the face of challenges.

The time to act is now, and the path is clear. Take charge of your home office expenses and let them work for you, enhancing your business's financial health, one deduction, and credit at a time.