Home Office Expenses Calculator Spreadsheet | GST & Income Tax Deductions

Nick Houldsworth

Introducing the Ultimate Home Office Expenses Calculator Spreadsheet Template

Are you navigating the complexities of managing your home office deductions? Whether you're a small business owner or a sole trader in New Zealand, Australia or the United Kingdom, our comprehensive home office deduction spreadsheet is designed to streamline your tax preparation. Traditionally a task for professional accountants, this Excel or Google Sheets home office expenses calculator template demystifies the process of calculating your year-end tax deductions.

Why Choose Our Home Office Deduction Spreadsheet for GST and Income Tax Benefits?

Maximize Income Tax Deductions

Our home office write-off calculator is engineered to unlock significant savings on your income tax. The potential deductions depend on various factors, including the home office percentage of your house used for business purposes and the total operating expenses. By accurately calculating these figures, you could significantly lower your tax bill.

Claim GST / VAT Credits With Ease

For GST-registered individuals, our home office percentage calculator simplifies the process of identifying and claiming eligible GST credits, effectively lowering your business expenses

How to Use This Home Office Expenses Calculator

Step 1: Download or Make a Copy

Begin by downloading or creating a copy of our home office expenses calculator. This first step prepares you for personalising the spreadsheet with your specific data.

Step 2: Populate with Your Expenses

After inputting your data, the Summary Sheet of our home office expenses calculator will automatically highlight your potential tax deductions and GST credits. It's important to examine this summary for accuracy before proceeding.

Step 3: Use the Summary Sheet

Once you've entered your data, the Summary Sheet in the home office expenses calculator will automatically generate your potential tax deductions and GST credits. It's crucial to review this summary to ensure it's accurate and complete.

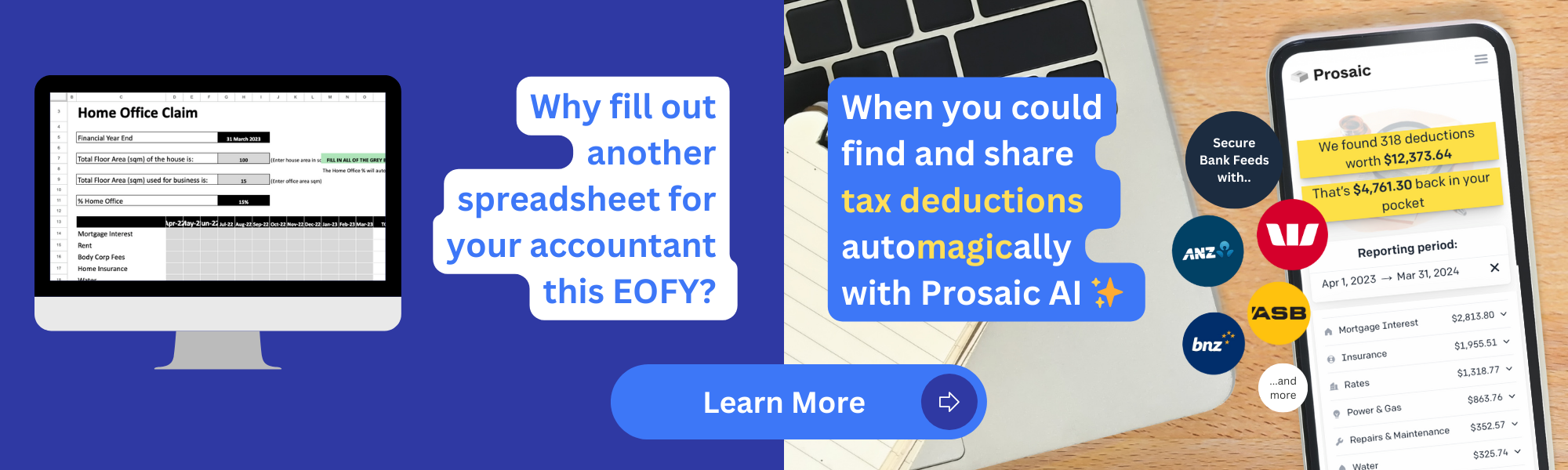

Don't like manually going through bank statements and bills to find home office expenses? Try Prosaic app to automatically find and calculate home office deductions from your banking data.

Next Steps with Your Home Office Deduction Spreadsheet

- Consult Your Accountant: For in-depth financial insights and tax strategy, forward your completed home office deduction spreadsheet to your accounting professional.

- Sync with Accounting Software: If you utilise accounting applications, integrate the summary data from the home office expenses calculator for streamlined financial management.

- DIY Tax Filing: Competent in self-managed tax filing? Use the detailed figures from our home office write-off calculator to accurately fill out your IR3B tax form. Remember to keep all relevant documents for future reference.

By making our home office expenses calculator a part of your tax preparation toolkit, you ease the burden of year-end calculations while enhancing your tax saving opportunities.